What is the DR 8453 Colorado form?

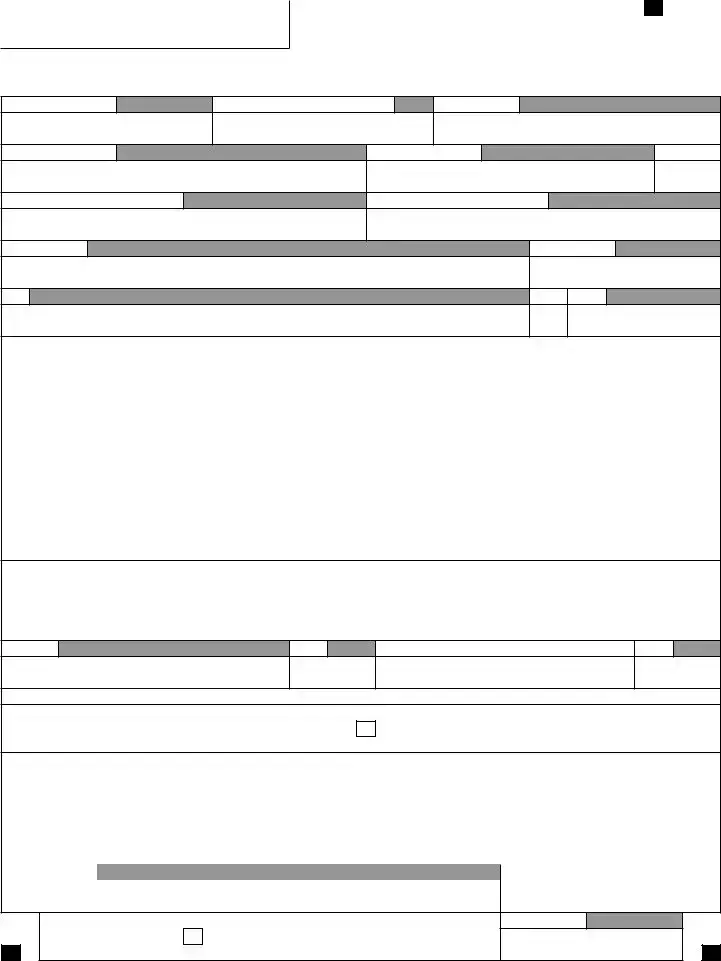

The DR 8453 Colorado form, also known as the State of Colorado Individual Income Tax Declaration for Electronic Filing, is a document that taxpayers must complete and sign when they choose to electronically file their Colorado income tax returns. It serves as a declaration that the information provided is accurate and matches the information submitted with their federal and state tax returns. This form must be retained by taxpayers or their Electronic Return Originators (EROs) for a specified period, as dictated by the Colorado statute of limitations, but it should not be mailed to the IRS or the Colorado Department of Revenue.

Who needs to sign the DR 8453 form?

All taxpayers filing their Colorado tax return electronically must sign and date the DR 8453 form at the time of filing. If filing a joint return, both spouses are required to sign and date the form. The completion and signature ensure that the electronic tax return will be recognized as complete and filed by the Colorado Department of Revenue.

What information is required on the DR 8453 form?

The DR 8453 form requires various pieces of information, including the taxpayer’s name, address, and Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN), as well as the Submission ID assigned by the tax preparation software. Additionally, taxpayers must report their total income, taxable income, Colorado tax amount, Colorado tax withheld, any refund amount, and any amount owed as indicated on their federal and Colorado tax forms.

Do I need to send the DR 8453 form to the Colorado Department of Revenue?

No, you should not send the DR 8453 form to the Colorado Department of Revenue or the IRS. Instead, this form should be kept by the taxpayer or their preparer for a duration specified by the Colorado statute of limitations. It acts as a record of electronic filing and may need to be presented upon request by the Colorado Department of Revenue.

What is the statute of limitations for keeping the DR 8453 form?

In Colorado, the general statute of limitations is the federal statute of limitations plus one year, which translates to four years from the due date of the Colorado return. This time frame dictates how long taxpayers or their preparers should retain copies of the DR 8453 form along with any related tax filings and documents.

What if an Electronic Return Originator (ERO) prepares my tax return?

If your tax return is prepared by an ERO, they are required to sign and date the DR 8453 form at the time of filing. The ERO, if also the preparer, must check the appropriate box, sign the form, and include their Social Security Number or preparer identification number (PTIN). Taxpayers using an ERO or preparer should retain copies of all documents for their records but are not required to submit anything to the Colorado Department of Revenue at the time of filing.

How can I get help with the DR 8453 form?

For assistance with the DR 8453 form or any questions related to electronic filing of your Colorado income tax return, visit the Colorado Department of Revenue website at Tax.Colorado.gov. The website offers comprehensive resources, guides, and contact information for taxpayers seeking help with their state tax obligations.