Page 4

Part-Year Colorado Residents and Nonresidents

Part-Year Colorado Residents and Nonresidents

Tax is prorated so that it is calculated only on income received

in Colorado or from sources within Colorado. We recommend you review publication FYI Income 6 if this applies to you. You will calculate your prorated tax by completing the DR 0104PN. You must submit the DR 0104PN with your return.

Persons Traveling or Residing Abroad

If you are traveling or residing outside the United States

on April 15, the deadline for filing your return is June 15, 2020. If you need additional time to file your return, you will automatically have until October 15, 2020, to file. Interest is

due on any tax paid after April 15, 2020. To avoid any late

payment penalties, you must pay 90% of your tax liability by June 15, 2020, file your return by October 15, 2020 and pay any remaining tax due at the time of filing. When filing your return, mark the “Abroad on Due Date” box on Revenue

Online or the paper return.

Active Duty Military

Active Duty Military

Under federal law, a military servicemember’s state of legal

residence does not change solely as the result of the service-

member’s assignment for service in another state. Consequently, a Colorado resident who enters into military service will remain a Colorado resident unless they officially change their state of

legal residence as described in DD Form 2058.

In general, military servicemembers who are Colorado residents are subject to the same income tax filing requirements as other

Colorado residents, even if they are serving in another state.

These requirements are described on the preceding page, under the heading “Who Must File This Tax Return.”

However, any military servicemember who spends at least 305 days of the tax year stationed outside of the United States on

active military duty may elect to be treated as a nonresident.

The servicemember may make this election by filing a return and checking the applicable box on Form 104PN.

Military servicemembers who are stationed in Colorado, but

are not Colorado residents, are not required to pay Colorado tax on their military income. However, any other Colorado source income of a nonresident servicemember is subject to

Colorado taxation.

Please see “Military Service Members — Special Filing Information” webpage on our website for additional information.

The residency rules described above for military servicemembers also apply generally to a

servicemember’s spouse if the spouse is residing with the servicemember either inside or outside of Colorado in compliance with the servicemember’s military orders. If a servicemember and their spouse

are nonresidents stationed in Colorado, any wages earned by the spouse for work performed in Colorado are not subject to Colorado taxation. The military spouse must complete a DR 1059, provide a copy to their employer when hired for employment, and submit a copy to the Department, along with a copy of their military ID card, when they file their Colorado return each year. The DR 1059 may be filed with the Department through Revenue Online, with DR 1778,

or as an attachment to a DR 0104 filed by paper.

Name and Address

Name and Address

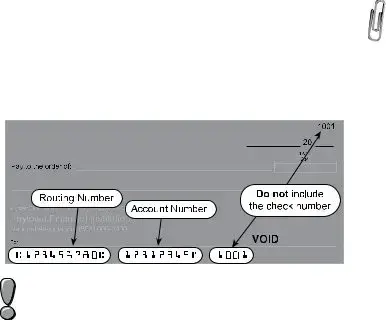

Provide your name, mailing address, date of birth, Social

Security number, as well as the state of issue, last four digits, and the date of issuance of your state issued ID card in the provided spaces. If filing Married Filing Joint, provide the spouse’s information where prompted. Provide the spouse’s information ONLY if filing a joint return. Otherwise leave blank. All Departmental correspondence will be mailed to

the mailing address provided. We recommend you read publication FYI General 2 for the Privacy Act Notice.

Line 1 Federal Taxable Income

Refer to your federal income tax return to complete this line:

• Form 1040 line 11b

If your federal taxable income is a negative amount, be sure to enter the amount as such on your Colorado return. If submitting a paper return, put the negative amount in parentheses, for example ($1,234).

Do not enter your total income or wages on this line because it will make your tax too high. The Department will compare the amount you list here to the return you file with the IRS, so be very careful

to complete this correctly.

Additions

Line 2 State Addback

Refer to your federal income tax return to complete this line.

Enter $0 if you filed Form 1040 or 1040SR but did not itemize

your deductions on Schedule A.

Taxpayers who deduct general sales taxes on Schedule A

line 5a, Form 1040 or 1040SR, are not required to calculate this addback. If you deducted state income tax on Schedule

A line 5a, complete the worksheet below to calculate the Income Tax Deduction.

We recommend that you read publication FYI

Income 4 for special instructions before completing the worksheet below.

Complete the following worksheet to determine your state

income tax deduction addback.

a) |

Is the amount on federal Form 1040 or |

|

|

1040SR Schedule A line 5d greater than |

|

|

the amount on federal Form 1040 or |

|

|

1040SR Schedule A line 5e? |

|

|

No. Enter the state income tax |

|

|

deduction from federal Form 1040 |

|

|

or 1040SR Schedule A line 5a. |

|

|

Yes. Subtract the amounts on federal |

|

|

Form 1040 or 1040SR Schedule |

|

|

A lines 5b and 5c from the |

|

|

amount on line 5e. Enter the |

|

|

result, but not less than $0. |

$ |

b) Total itemized deductions from federal |

|

|

Form 1040 or 1040SR Schedule A line 17 |

$ |

|

|

|

c) |

The amount of federal standard deduction |

|

|

you could have claimed (See instructions |

|

|

federal Form 1040 or 1040SR line 9 for |

|

|

2019 federal standard deductions.) |

$ |

$

Transfer to line 2 of the DR 0104 the smaller amount from line (a) or (d) of the worksheet above.

Active Duty Military

Active Duty Military Name and Address

Name and Address

• Bond

• Bond  • Alien

• Alien  Alternative Minimum Tax

Alternative Minimum Tax

Quarterly Estimated Payments

Quarterly Estimated Payments Innovative Motor Vehicle and

Innovative Motor Vehicle and

Taxation Website

Taxation Website Estimated Tax Requirements

Estimated Tax Requirements

U.S. Government Interest

U.S. Government Interest Pension and Annuity

Pension and Annuity Spouse Pension and

Spouse Pension and Military Retirement Subtraction

Military Retirement Subtraction Spouse Military Retirement

Spouse Military Retirement Colorado Capital Gain

Colorado Capital Gain

CollegeInvest Contribution

CollegeInvest Contribution Qualifying Charitable Contributions

Qualifying Charitable Contributions PERA/DPSRS Subtraction

PERA/DPSRS Subtraction Railroad Benefit

Railroad Benefit Wildfire Mitigation Measures

Wildfire Mitigation Measures