What is the Colorado Exemption form DR 0563?

The Colorado Exemption Form DR 0563 is a document issued by the Colorado Department of Revenue that allows businesses and individuals to claim exemption from state and local sales taxes for certain purchases. This form is to be used in specific situations where the buyer is either a wholesaler, retailer, manufacturer, charitable or religious organization, political subdivision, governmental agency, or qualifies under another specified exemption category. The form requires detailed information about the buyer, the nature of their exemption, and, if applicable, their state and city registration numbers for sales tax.

Who needs to complete the Colorado Exemption Form DR 0563?

Businesses and individuals who are eligible for a sales tax exemption in Colorado must complete the Form DR 0563. Eligible parties include wholesalers, retailers, manufacturers, charitable or religious organizations, political subdivisions, governmental agencies, and any other entities that qualify for a statutory exemption. This form serves as evidence of the purchaser's right to claim a sales tax exemption.

How can a business qualify for a sales tax exemption using Form DR 0563?

To qualify for a sales tax exemption using Form DR 0563, a business must fall into one of the specified categories such as wholesaler, retailer, manufacturer, charitable or religious organization, political subdivision, governmental agency, or have another specific statutory exemption. The business must provide accurate information on the form regarding its status, as well as its city and state sales tax registration or ID numbers if it plans to resell or lease the purchased items in the course of its normal business operations. Careful adherence to the form's instructions is necessary to ensure compliance and qualification for the exemption.

What are the responsibilities of a purchaser using the Colorado Exemption Form DR 0563?

A purchaser using the Colorado Exemption Form DR 0563 is responsible for providing accurate and truthful information regarding their exemption status, including their business type and state and city registration numbers, if applicable. The purchaser must also ensure that the items bought tax-free are used in a manner consistent with the claimed exemption. Should any purchased items be used or consumed in a way that makes them subject to sales or use tax, the purchaser is responsible for reporting and paying those taxes directly to the appropriate taxing authority.

What information is required to complete Form DR 0563?

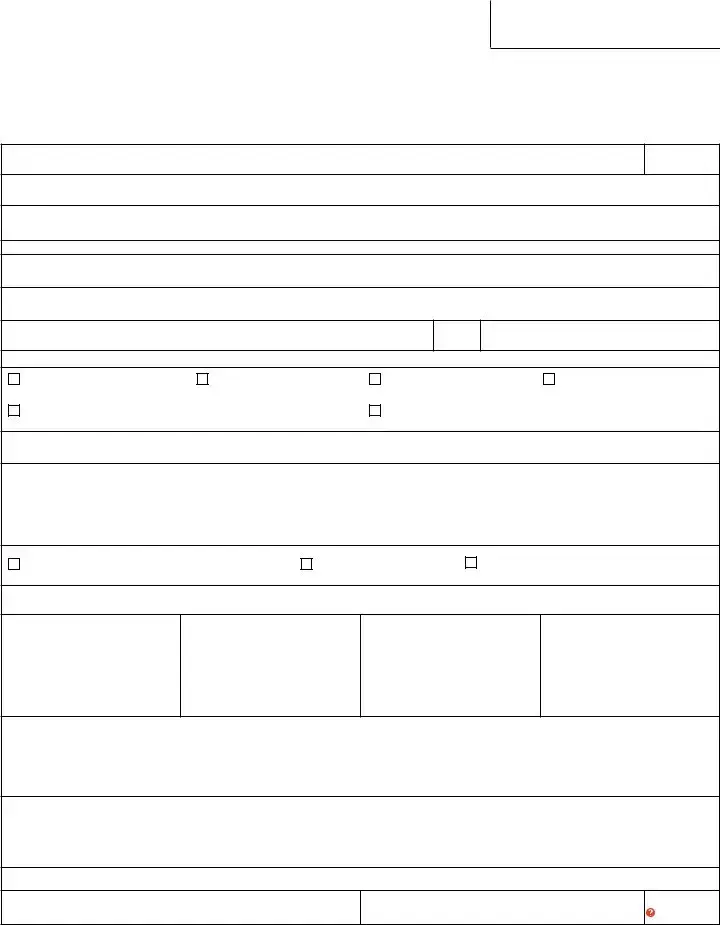

Completing Form DR 0563 requires providing detailed information including the last name or business name, address, city, state, ZIP code, and the nature of the buyer's qualification for exemption (e.g., wholesaler, retailer, manufacturer, charitable or religious organization). Additionally, if claiming exemption on the basis of resale or lease, city or state registration, or ID numbers for the jurisdictions where the items will be resold or leased must be included. The form also mandates a general description of the products to be purchased and a declaration that the information provided is accurate.

What happens if the Colorado Exemption Form DR 0563 is not correctly filled out?

If the Colorado Exemption Form DR 0563 is not correctly filled out, it may result in the denial of the sales tax exemption claim. Incorrect or incomplete forms put both the seller and the purchaser at risk of being audited or fined. Sellers are obligated to collect state sales tax for transactions where an exemption is claimed but not properly documented through a correctly completed exemption certificate. Therefore, ensuring the form is accurately and thoroughly completed is essential.

Can the Colorado Exemption Form DR 0563 be revoked?

Yes, the Colorado Exemption Form DR 0563 can be revoked by the issuing authority if it's determined that the exemption was incorrectly granted or if the form was misused. Additionally, the purchaser can cancel their exemption status by providing a written notice of cancellation to the seller. It is essential for both parties to maintain accurate and updated records, as changes in business operations or exemption qualifications may affect the validity of the exemption.

How often does the Colorado Exemption Form DR 0563 need to be updated or renewed?

The Colorado Exemption Form DR 0563 does not have a specific expiration date and remains effective until canceled by the purchaser in writing or revoked by the city or state. However, it is prudent for purchasers to regularly review and update their exemption status and related documentation to ensure compliance with current laws and regulations. Sellers should also request updated exemption certificates periodically to maintain accurate records and ensure all tax-exempt sales are properly documented.