What is the purpose of the Colorado DR 8453 form?

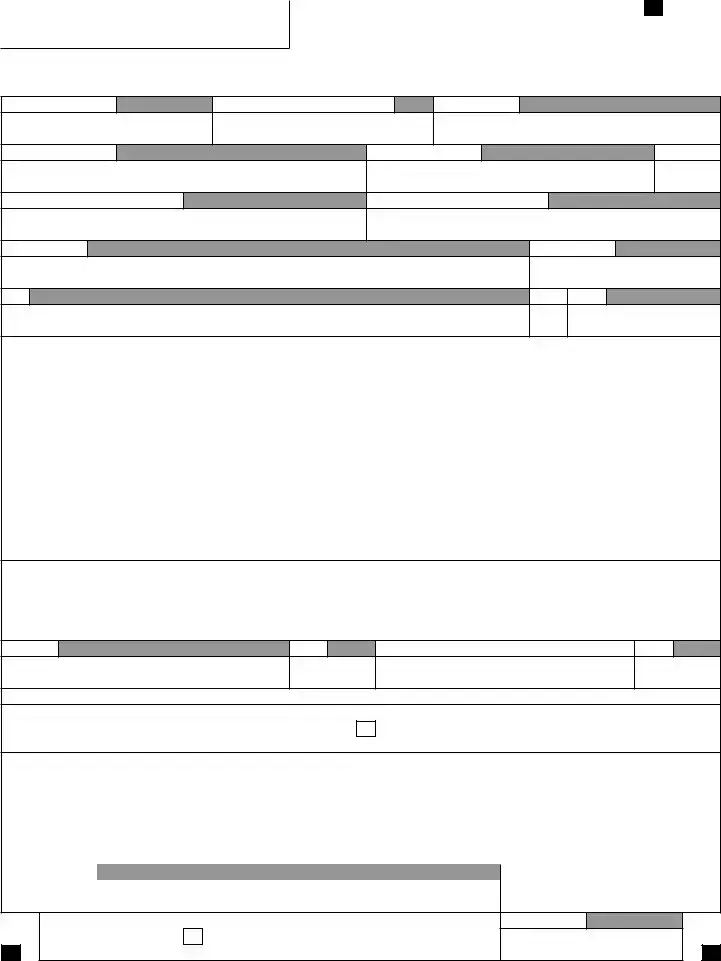

The Colorado DR 8453 form is an Individual Income Tax Declaration for Electronic Filing. It acts as a declaration by the taxpayer that the information provided for electronic filing is accurate and agrees with the amounts shown on their federal and Colorado income tax returns. This form is a crucial component for taxpayers choosing to file their taxes electronically, as it confirms the accuracy of the electronically submitted data.

Who needs to file the Colorado DR 8453 form?

This form is specifically for taxpayers in Colorado who opt to file their income tax returns electronically. Both individual taxpayers and those filing jointly with a spouse are required to use this form to validate the information transmitted electronically to the Colorado Department of Revenue.

Should I send the DR 8453 form to the IRS?

No, you should not send the DR 8453 form to the IRS. The instructions explicitly state that this form should not be mailed to the IRS or the Colorado Department of Revenue. Instead, it should be retained with your records as proof of your electronic filing.

What information is required on the DR 8453 form?

To complete the DR 8453 form, you'll need to provide detailed information from your federal and Colorado state income tax returns. This includes total income, taxable income, Colorado tax owed or refunded, and any Colorado tax withheld. Additionally, you must provide personal identifying information, such as social security numbers and contact details.

Is the DR 8453 form complicated to fill out?

While the form requires specific information, it is not overly complicated to fill out. The form is designed to collect exact figures from your federal and state tax returns, so it's essential to have those documents handy when preparing the DR 8453. Accuracy and attention to detail are key to completing the form correctly.

What happens if I make a mistake on the form?

If a mistake is discovered on the DR 8453 form after electronic filing, you may need to take corrective actions. Depending on the nature of the mistake, this could involve amending your tax return. It is advisable to consult with a tax professional or contact the Colorado Department of Revenue for guidance on the specific steps to rectify any errors.

Can I file this form if I am using a tax preparer or software?

Yes, even if you are using a tax preparer or tax preparation software, you can still utilize the DR 8453 form for electronic filing. In fact, if a tax professional prepares your return, they will likely provide you with this form to sign, acknowledging the accuracy of your tax return information before it is filed electronically. The form also includes a section for the declaration of the electronic return originator (ERO), preparer, or transmitter, if applicable.

What if I am filing a joint return?

For joint returns, both spouses must provide their information on the form, including social security numbers and signatures. This ensures that both parties agree with the information provided and the amounts declared for electronic filing. The process for filing jointly electronically mirrors that of individual filers, requiring both to consent to the submission of their tax data.

How long should I keep the DR 8453 form for my records?

It is recommended to keep the DR 8453 form for at least three years from the date of filing or two years from the date the tax was paid, whichever is later. Keeping it for the recommended duration ensures that you have necessary documentation available in case of an audit or if questions arise from the Colorado Department of Revenue regarding your return.

Where can I get assistance if I have questions about filling out the DR 8453 form?

If you have questions about the DR 8453 form or need assistance in filling it out, several resources are available. You can contact a tax professional, visit the Colorado Department of Revenue's website at www.taxcolorado.com, or reach out to the department's customer service. These resources can provide you with the guidance needed to accurately complete and understand the form.