What is the Colorado DR 1102 form used for?

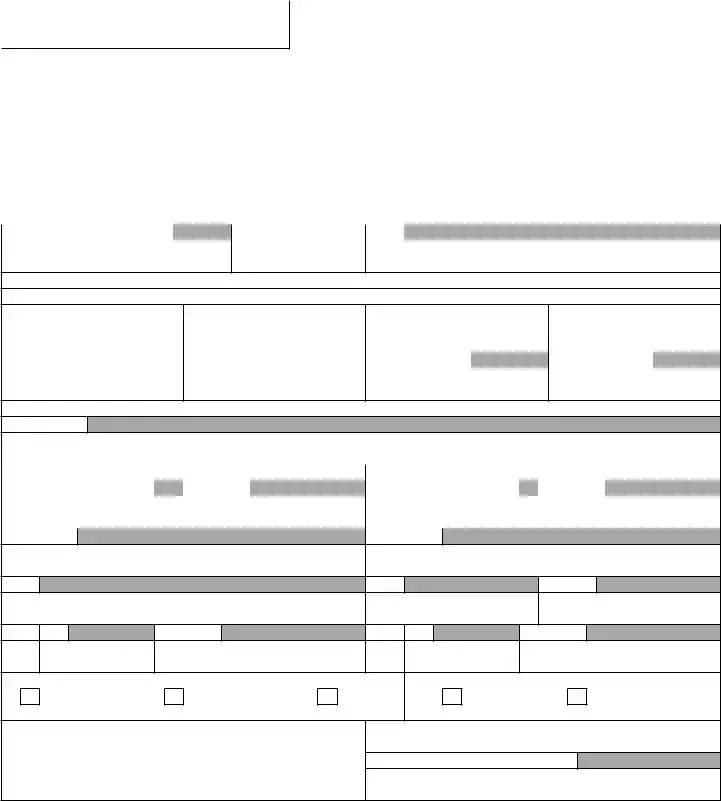

The Colorado DR 1102 form is a document designed to inform the Colorado Department of Revenue about changes to your business. These changes can include a change in the business name or address, or the closure of the business. It's used by businesses that are registered for Colorado sales tax, withholding tax, or retailer’s use tax. If you're closing your account or moving to a new location, you need to complete and submit this form to ensure the state has your updated information or to officially close your tax accounts.

How can I submit the Colorado DR 1102 form?

The DR 1102 form can be submitted in two ways: through the mail or online via Colorado's Revenue Online portal. If you choose to mail the form, it should be sent to the Colorado Department of Revenue at the address listed on the form. For a faster, more secure submission, you can use Revenue Online at Colorado.gov/RevenueOnline. This online service not only allows you to submit the form but also offers access to various services and detailed information to help with your business's tax needs.

What should I do if my business has changed location?

If your business has changed its location, you should provide both the Colorado Account Number (CAN) and the branch or site ID specific to the new location when filling out the DR 1102 form. This information helps the Department of Revenue update your records accurately and prevent any delays in processing or incorrect billing. Additionally, if your business has changed jurisdiction, you're advised to download a single flat DR 0100 form from the Colorado Department of Revenue website to ensure you collect and remit the correct sales tax for your new location.

Is there anything special I need to do if my business has changed its name?

Yes, if you've changed your business's corporate name, you must include the Amended Articles of Incorporation from the Secretary of State’s Office along with your DR 1102 submission. This extra step is crucial as it provides legal proof of your business name change, ensuring that your tax accounts reflect the correct information.

What happens after I submit my DR 1102 form for business closure?

Once you submit your DR 1102 form indicating business closure, the Colorado Department of Revenue will process your request and officially close your tax accounts for the specific tax types you’ve indicated. It is important to specify the effective date of closure and to ensure all final tax responsibilities are met. After closure, you should no longer file returns for the closed account, although you may receive final documents or confirmations from the Department as part of the closing process.