What is the Colorado DR 0204 form?

The Colorado DR 0204 form is a document used to calculate penalties related to the underpayment of estimated taxes by individuals. This computation is necessary when individuals have not paid their estimated tax payments for the year on time or in the correct amount. The form is structured to help taxpayers determine if they owe a penalty and, if so, calculate the exact amount owed to the Colorado Department of Revenue.

Who needs to fill out the Colorado DR 0204 form?

Individuals who did not pay their estimated taxes correctly or on time for the tax year need to fill out the DR 0204 form. This typically applies to those who have income not subject to withholding tax, such as earnings from self-employment, interest, dividends, rents, or alimony. It's crucial for taxpayers who anticipate owing $1,000 or more in Colorado tax after subtracting withholdings and credits to review their need for this form.

Are there any exceptions to avoid the penalty calculated on the DR 0204 form?

Yes, there are exceptions that can help an individual avoid the penalty for underpayment of estimated taxes. The first exception is for individuals whose gross income is at least two-thirds from farming or fishing; if they file their return and pay the full tax due by March 1 following the tax year, no penalty is applied. Additionally, if the sum of the taxpayer's withholding tax and estimated tax payments equals or exceeds the amount of tax shown on their return for the previous year, they may not be subject to the penalty.

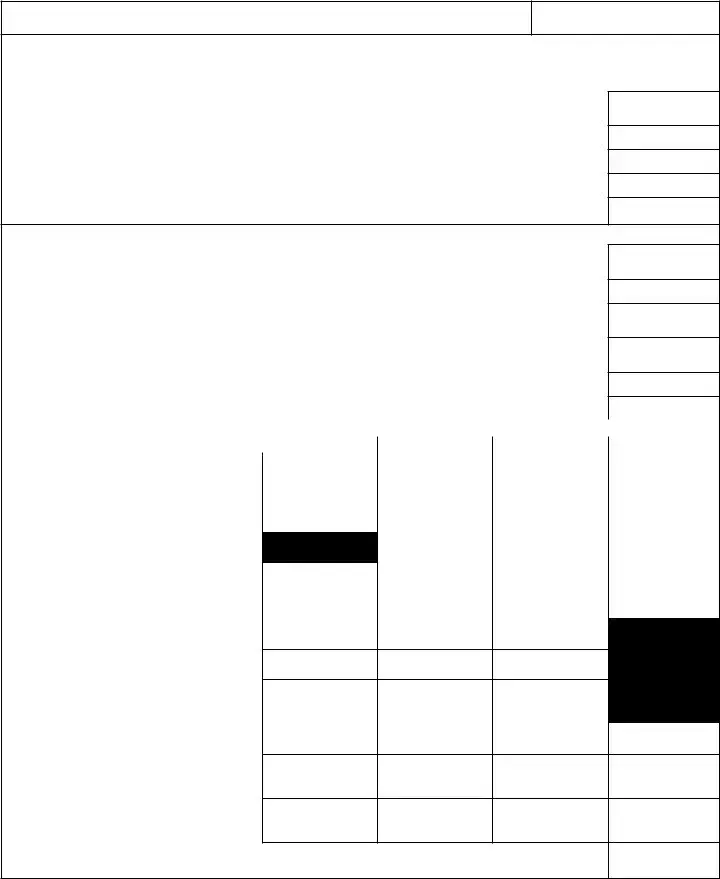

How is the required annual payment calculated on the form?

The required annual payment amount on the DR 0204 form is the lesser of 70% of the current year's net Colorado tax liability or 100% (or 110% for higher income earners) of the previous year's net Colorado tax liability. This calculation is aimed at ensuring taxpayers pay a sufficient amount of their estimated taxes throughout the year to avoid a penalty.

What are the payment due dates for estimated tax payments?

Estimated tax payments are due in four equal installments on April 15, June 15, September 15 of the tax year, and January 15 of the following year. These dates are critical for avoiding penalties for underpayment, as payments must be made on or before these deadlines.

Can taxpayers use the annualized installment method when calculating the penalty?

Yes, taxpayers who do not receive their income evenly throughout the year have the option to calculate their estimated tax payments using the annualized income installment method. This method takes into account when the income was earned during the year, allowing for potentially smaller penalty calculations due to uneven income distribution. To use this method, taxpayers must complete the annualized installment method schedule on the DR 0204 form.

Where can individuals find more information or assistance with the DR 0204 form?

For more detailed information or assistance with filling out the DR 0204 form, individuals can visit the Colorado Department of Revenue's official website at WWW.TAXCOLORADO.COM. Additionally, the FYI Income 51 publication available on the website provides extensive guidance on estimated tax payments and penalties.