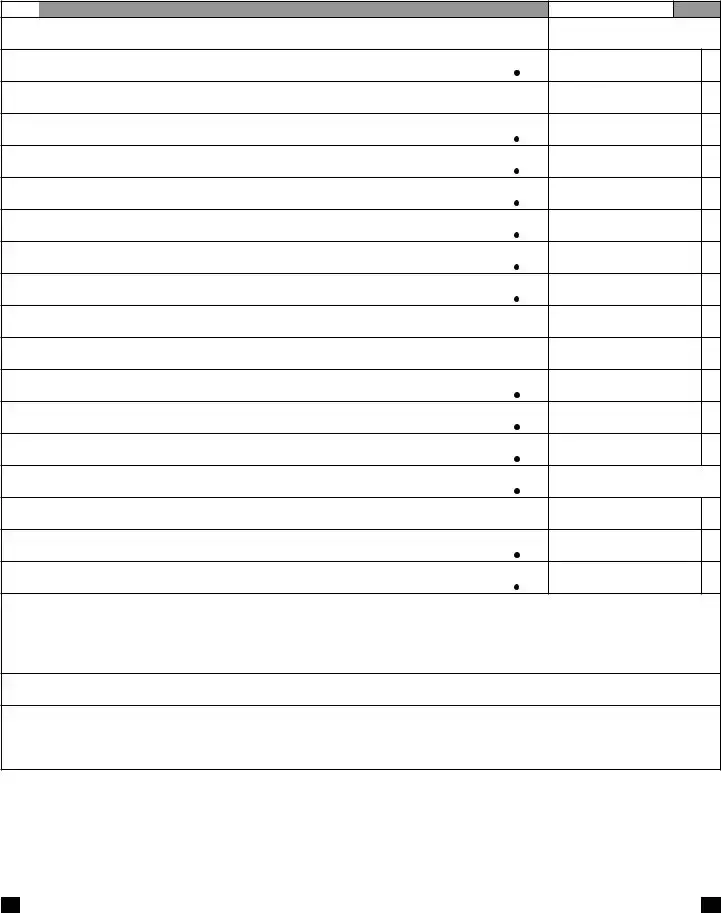

What is the purpose of the Colorado 112 form?

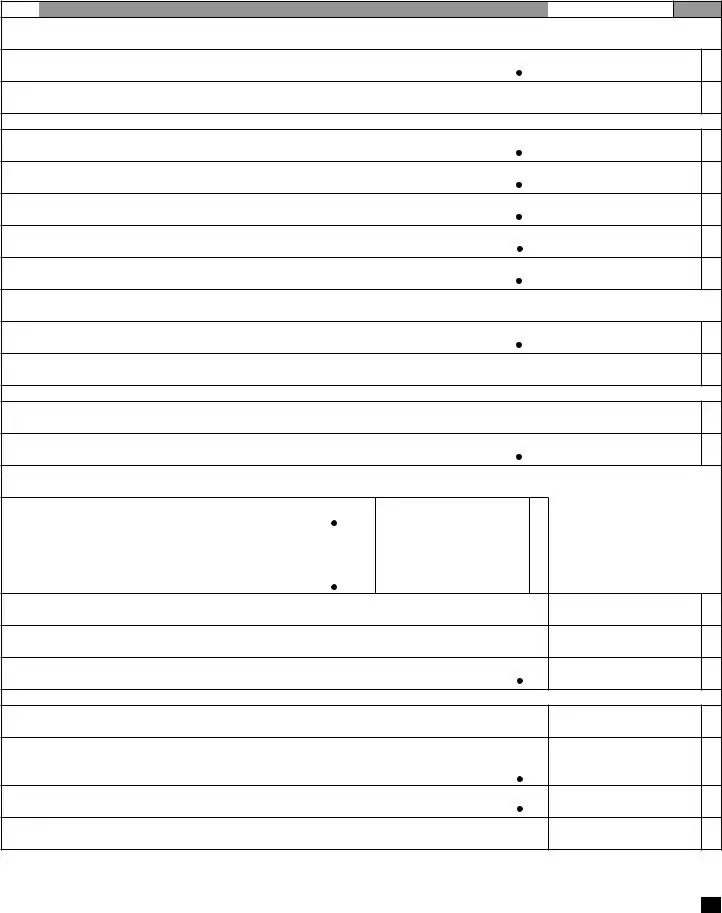

The Colorado 112 form is designed for C Corporations filing their Colorado C Corporation Income Tax Return. It encompasses various components such as instructions, tax return form DR 0112, extension form DR 0158-C, tax payment form DR 0900C, Schedule RF for Receipts Factor Apportionment, Schedule C for Colorado Affiliations, and credit schedule DR 0112CR. Its primary purpose is to facilitate the accurate filing and payment of state income taxes by C Corporations within Colorado.

When is the Colorado 112 form due?

The due date for filing the Colorado 112 form aligns with the fifteenth day of the fourth month following the end of your tax year. For corporations operating on a traditional calendar year, the due date is April 15th. For the year 2020, the specific due date was April 15, 2021.

How can I get an extension for filing the Colorado 112 form?

Extensions for filing the Colorado 112 form are granted automatically. To utilize this extension, you do not need to file any forms unless you are also making a payment. If you need to make a payment alongside your extension, you should use form DR 0158-C. This grants you an additional six months to file, making the extended due date October 15, for calendar year filers.

How should I submit payment if I file electronically?

If you have filed your Colorado 112 form electronically and need to submit a payment by check, you must include the DR 0900C form with your payment. This ensures that your payment is correctly applied to your tax account. Payments should be made payable to the Colorado Department of Revenue and mailed to the specified address, with the correct identification and form numbers included on your check or money order.

What are the penalties for late filing or payment?

Although there is an extension for filing, there is no extension for the payment due date. If the payment is not made by the due date, penalty and interest may be assessed. For specific penalty rates and interest calculations, it's recommended to review FYI General 11 or consult directly with the Colorado Department of Revenue.

Can I pay my Colorado 112 form taxes online?

Yes, the Colorado Department of Revenue encourages taxpayers to pay online through Colorado.gov/RevenueOnline. This platform reduces errors and provides instant payment confirmation. Taxes can be paid using Electronic Funds Transfer (EFT), debit, or credit options, which are free services offered by the department. Online payment negates the need to send in form DR 0158-C if paying under extension.

What should I do if no payment is due with my Colorado 112 form?

If no payment is due with your Colorado 112 form, you do not need to file the DR 0900C or DR 0158-C forms. Simply file your DR 0112 income tax return and any applicable schedules without these payment or extension documents.

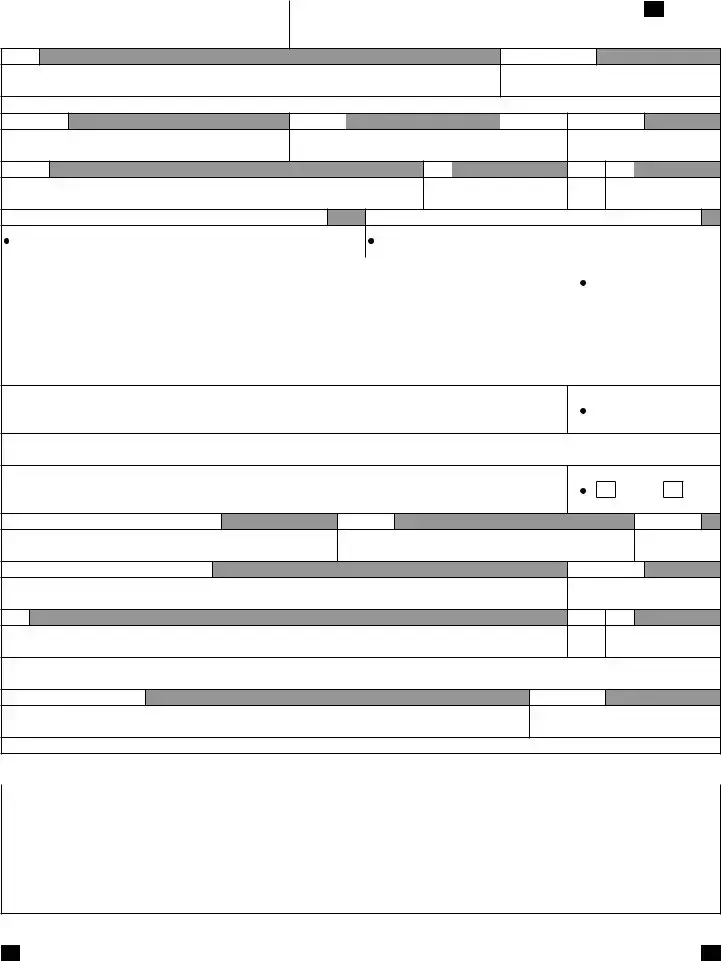

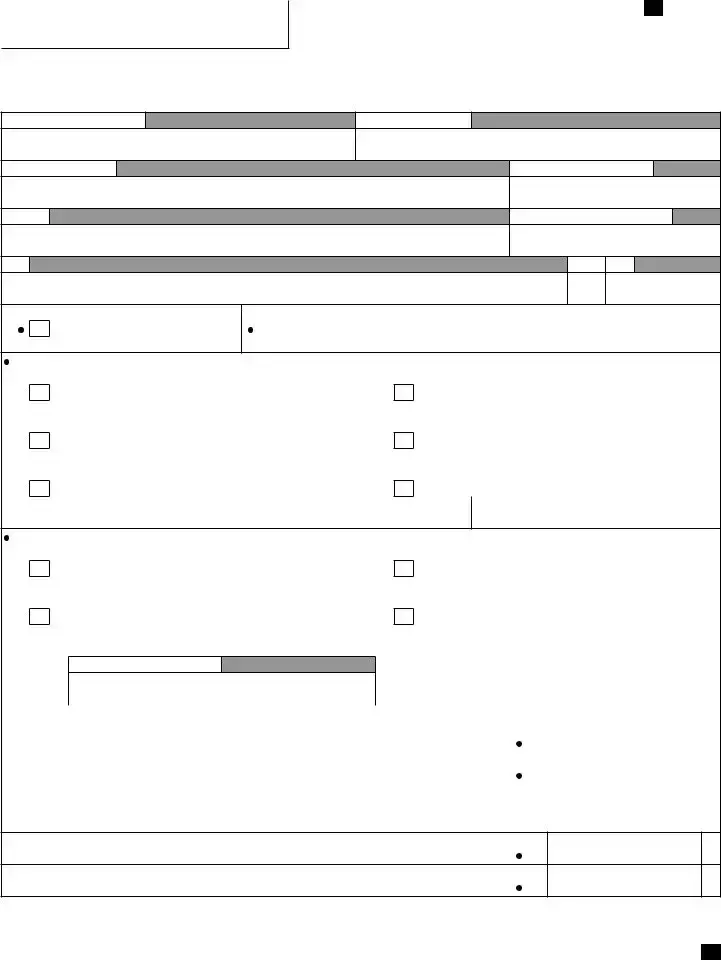

Colorado Account Number

Colorado Account Number Federal Employer ID Number

Federal Employer ID Number Enter the year of election

Enter the year of election

20

20