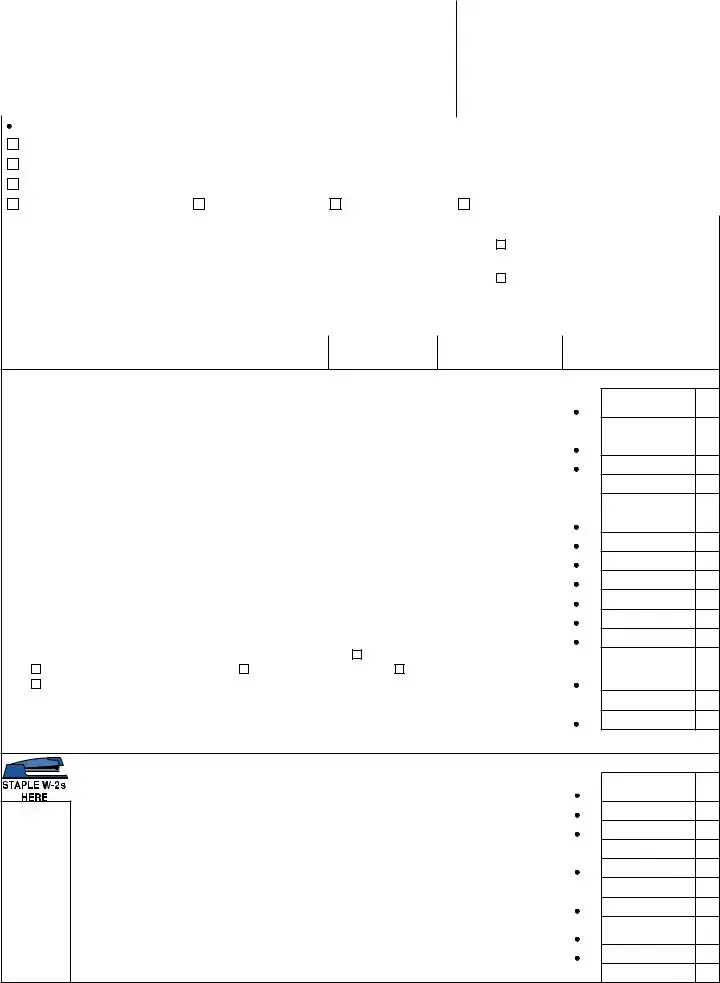

The 2010 Form 104X, Amended Colorado Income Tax Return, is used to correct your 2010 individual income tax return. For more information or any questions pertaining to income, additions, subtractions, credits, etc., refer to the income tax book for 2010, or call the Department of Revenue at (303) 238-SERV (7378). You can also obtain forms and information from the Web site at WWW.TAXCOLORADO.COM

Complete Form 104X showing the correct amounts for income, additions, subtractions, taxes and credits.

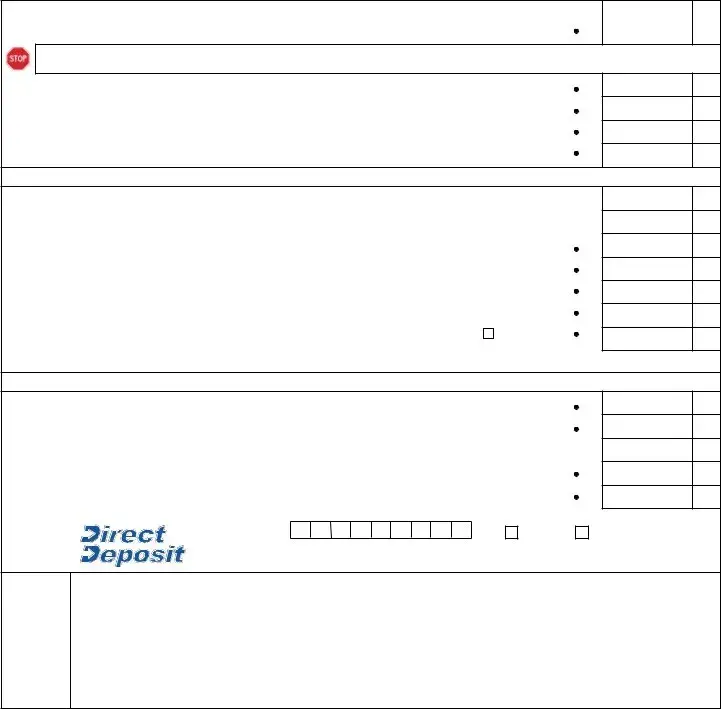

AMOunt OWED

Lines 30 through 36 compute the amount owed to the state on the amended return. Any decrease in the amount of the overpayment (line 30) or increase in the amount owed (line 31) will indicate that an amount is owed with the amended return.

REFunD AMOunt

Lines 37 through 41 compute the amount of credit available on the amended return. Any increase in the amount of the overpayment (line 37) or decrease in the amount owed (line 38) will indicate that an overpayment is available with the amended return. The overpayment can be credited to estimated tax (line 40) for the tax year following the period on the amended return, or can be requested as a refund (line 41).

Attachments:

Attach an explanation of the changes to your return and, if applicable, required attachments (e.g. 104CR, DR 0204) and certiications (e.g. DR 0074). All attachments and certiications must be included with

the amended return even if there is no change to that credit or tax attribute. Part-year residents and nonresidents attach corrected Form 104PN. If this amended return is the result of an adjustment made by the Internal Revenue Service attach a copy of the federal revenue agent’s report with supporting schedules. To expedite your refund, attach a

copy of the federal record of account to support any changes to federal taxable income (such as a mutual fund, brokerage irm or credit union)

in the United States.

Direct Deposit:

Complete the direct deposit information if you want your refund

deposited directly into your account at a United States bank or other inancial institution.

Foreign Address:

If you are entering an address for a foreign country, use the “State” ield for the foreign country and enter the foreign postal code in the “ZIP Code” ield. A Province may be included in the “City” ield with

the city.

Deceased taxpayer:

If the taxpayer died since the original return was iled and you are

requesting a refund, attach a copy of DR 0102 — Claim for Refund

Due Deceased Taxpayer and a copy of the death certiicate. Check

the deceased box after the decedent’s name.

A federal net operating loss carried back to a tax year beginning on or after January 1, 1987, or carried forward will be allowed for Colorado income tax purposes. A nonresident or a part-year resident may carry back or forward that portion of his federal net operating loss that is from Colorado sources or which relates to the Colorado portion of the year.

statute of limitations:

The statute of limitations for iling a Colorado claim for refund is generally four years from the original due date of the return or three years from the date of last payment of tax for the year involved, whichever is later.

The statute of limitations for claiming a refund that is the result of a loss carry-back or an investment tax credit carry-back is four years from the due date of the return for the year in which the loss or credit originated. See FYI General 18.

Protective claims:

If this amended return is being iled to keep the statute of limitations open pending the outcome of a court case or tax determination in

another state that affects your Colorado return, check the protective claim box under reason for iling corrected return.

Change in iling status:

If the amended return is being iled to change the iling status from single or married separate to joint, the taxpayer that iled the single return must be listed irst on the amended return. If both taxpayers have iled single, then either taxpayer can be listed irst and the explanation must specify that one of the original returns was iled

under a different primary Social Security Number (SSN).

If the amended return is being iled to change the iling status from

joint to single or married separate, the taxpayer whose SSN was

listed irst on the joint return should include all applicable tax data in

their amended return. The taxpayer whose SSN was listed second on the joint return must have an explanation that speciies the original return was iled under a different primary SSN.

interest rates on additional amounts due are as follows: |

|

January 1 through December 31, 2011. |

|

Tax due paid without billing, or paid within 30 days of billing |

3% |

Tax due paid after 30 days of billing |

6% |

Mail and make checks payable to:

colorado Department of Revenue Denver cO 80261-0005