What is the Colorado 104 form?

The Colorado 104 form is an Individual Income Tax Return document that residents, part-year residents, or non-residents of Colorado must file to report their income tax to the Colorado Department of Revenue. This form is essential for calculating the tax owed to the state or determining the refund due to the taxpayer.

Who needs to file a Colorado 104 form?

Any individual who has earned income in Colorado during the tax year, whether a full-year resident, a part-year resident, or a non-resident who has Colorado source income, is required to file a Colorado 104 form. This requirement also applies to individuals who are combining resident and non-resident periods within the same tax year.

Are there any specific attachments required with the Colorado 104 form?

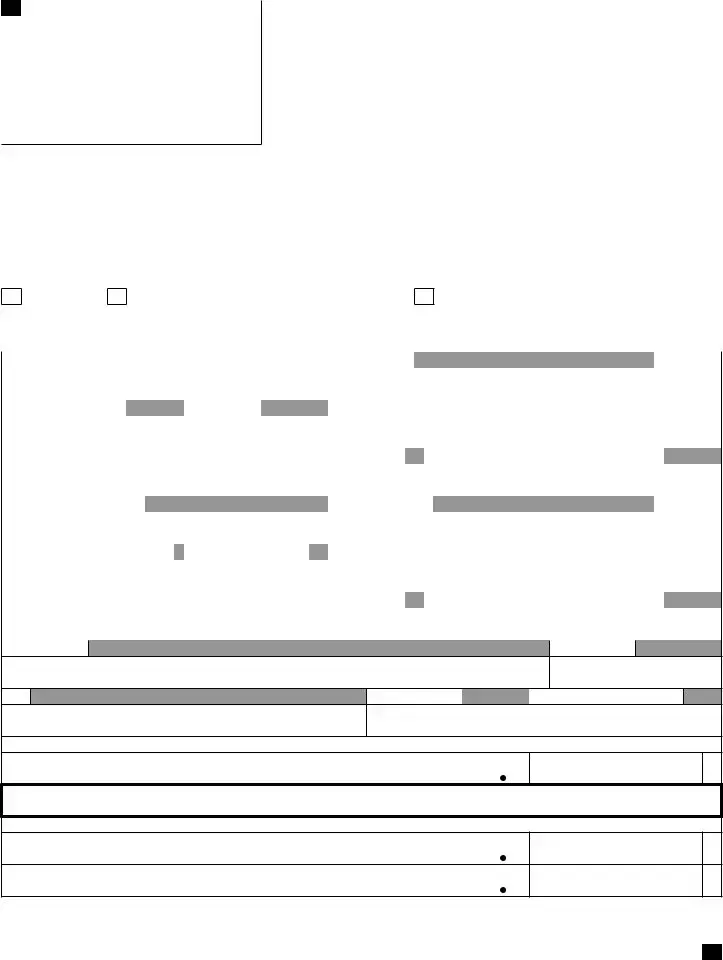

Yes, certain attachments may be necessary depending on individual circumstances. These include W-2s and 1099s with Colorado withholding, the DR 0104PN if part-year resident taxes apply, the DR 0104AD schedule for subtractions, as well as any other documentation for credits or deductions claimed such as the DR 0104CR for nonrefundable credits.

How is Federal Taxable Income reported on the Colorado 104 form?

Federal Taxable Income is reported in line 1 of the form and is taken from the federal income tax return's line 15 (1040 form) or line 15 (1040-SR form). This figure serves as the starting point for calculating Colorado income tax.

What are additions and subtractions in the context of Colorado tax?

Additions are specific amounts that Colorado requires to be added back to your Federal Taxable Income, due to differences in state and federal tax laws. Subtractions are amounts that Colorado allows you to deduct from your Federal Taxable Income, recognizing expenses or income sources taxed differently at the state level.

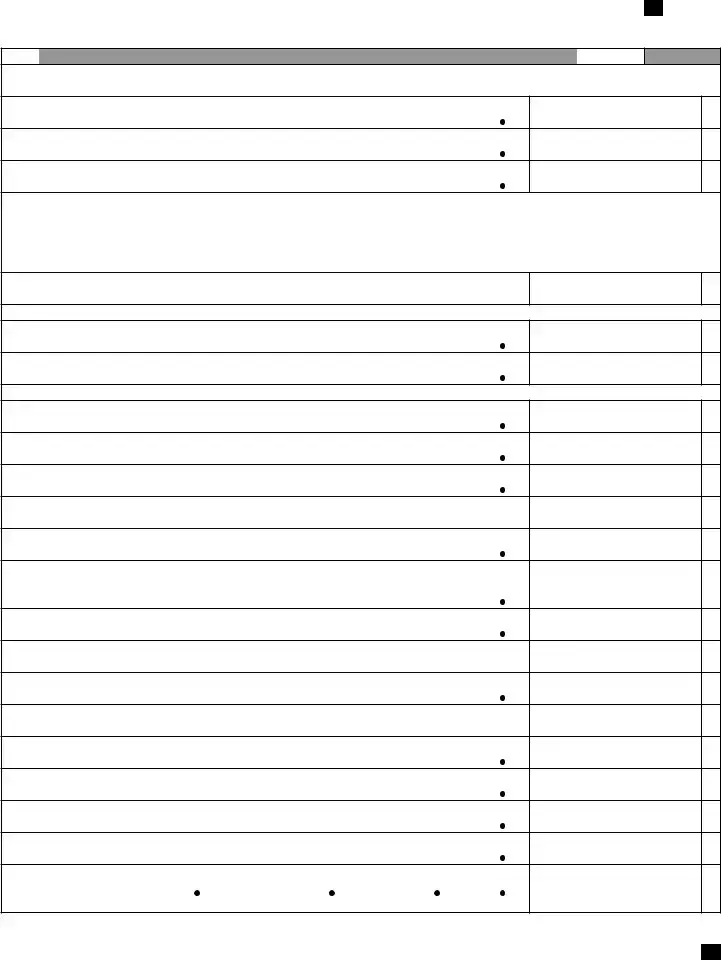

What are some examples of nonrefundable credits on the Colorado 104 form?

Nonrefundable credits include amounts for things like enterprise zone credits, childcare expenses, innovative motor vehicle credits, and more. These credits can reduce your tax owed but not below zero.

Can you explain the use tax reported on the Colorado 104 form?

The use tax line on the Colorado 104 form relates to taxpayers reporting use tax on purchases made without paying Colorado sales tax. This generally applies to items bought outside the state or online where sales tax was not collected at the time of purchase.

How does a taxpayer report a refund or amount owed on the Colorado 104 form?

If a taxpayer has overpaid their taxes (meaning their withholdings and credits exceed their net tax), they report this as a refund owed to them using line 32. If taxes owed exceed prepayments and credits, the amount owed by the taxpayer is reported on line 37, along with any applicable penalties and interest.

Where should the Colorado 104 form be filed?

The completed Colorado 104 form can be filed electronically through Colorado's Revenue Online system. For those filing with a payment, the form and check should be mailed to the Colorado Department of Revenue at the address specific for returns with payments. Those filing without a payment should send their form to a different address also specified for non-payment returns.